does cash app charge international fees

Instead most of its services are free of cost instead of a couple in which you are liable to pay the associated fee. Is there a fee for receiving money on cash APP.

The 13 Cash App Scams To Be Aware Of Update 2022

However these fees are deficient.

. Although employing a broker is normally connected with a minor cost there is one for settling the transaction. You can also learn more about other Cash App fees here. You can use it to determine how much you should spend to utilize Cash App.

15 with a 025 minimum. ATM fees are reimbursed if you have at least 300 per month in direct deposits. Every time you use your credit card to send money Cash App will charge you a 3 fee.

Withdrawing money from your account instantly. Payments made with your debit card or bank account are not charged by the app. Cash App doesnt charge foreign transaction fees for using your Cash Card for purchases in or from other countries.

If the recipient lives in Canada Mexico and so forth. There are no fees to send or request payments outside your region using Cash App. Every time you use your credit card to send money Cash App will charge you a 3 fee.

There is no fee for receiving money into your account. When you use your debit card or bank account to make a payment Cash App does not charge you any fees. Typically Cash App transfers take about 2-3 days to be completed like a regular bank transfer.

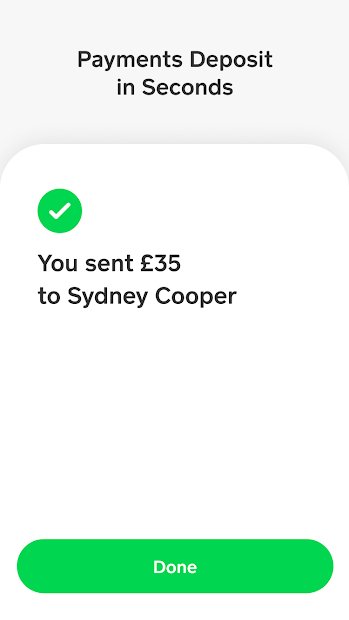

Cash App Support International Payments. When you send a payment outside the UK Cash App will convert the payment from GBP to USD based on the mid-market exchange rate at the time the payment is created and your recipient will receive the funds in USD. Cash App isnt an expensive or bank-breaking platform.

If you transfer someone 200 using the Cash App and your connected credit card youll be charged 206. Cash App offers instant deposits to your linked debit cards and standard deposits to your bank account. But wait arent transactions free with a personal account.

There are no additional expenses for standard transfers. Cash App charges a 3 on money transfer via credit card 15 of the total amount on instant funds transfer 2 to 3 fee on cryptocurrency and 2 on per ATM withdrawal. However they do charge the following fees.

Cash App does not charge monthly fees inactivity fees or foreign. Bank-to-bank transfers with Cash App are free. However you would be charged a 3 percent transaction fee if you make a payment using a credit card.

Youll pay 206 if you send someone 200 via the Cash App with your linked credit card. Cash App international alternatives. Cash App offers a Visa Debit card that allows users to make in-person purchases and ATM withdrawals.

Cash App doesnt charge any inactivity or foreign transaction fees. Cash App for business is less about getting unique features than about being in compliance with your terms of service. Cash App charges 2 and youll pay any fee charged by the ATM operator outside of the Visa network.

Sending money using a credit card. Instead if you use the Cash app for commercial purposes you will be charged a modest fee. With the help of the Cash app you may send and receive money virtually anywhere in the United States.

Here are the fees for Cash App business accounts. You can expect to pay these fees. When used for simple transfers the cash app is cost-free to use.

You wont be charged a fee to clear transactions using Cash App. Any payments made on Cash App using a debit card or bank account are free. However if you need to send funds instantly you can pay a rush fee of 15 of the transfer amount.

125 fee minimum 025 on instant deposits. If you send money to someone outside of the United States you will only pay a flat fee of 495. No you are not required to pay a charge.

There are no fees to send or request. These are the activities on your Cash App account that incur fees. Cash App will provide the exchange rate on the payment screen before you complete it.

There are also fees to pay when you use the Cash App card including a 2 USD charge per ATM withdrawal⁴. You can now send or request Cash App payments with friends located in the US. Yes Cash App charges international fees.

Cash App uses the current mid-market exchange rate for international payments which is determined by the current buy and sell rates with no additional fee included by Cash App. Cash App Costs and Fees.

What Is Cash App And How Does It Work Forbes Advisor

Can You Use A Credit Card On Cash App Learn How To Link Your Debit Or Credit Card Here Apps

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Cash App Card Features And How To Get One Gobankingrates

How To Cash Out On Cash App And Transfer Money To Your Bank Account

How To Get Free Money On Cash App Gobankingrates

What Does Pending Mean On Cash App Learn All About The Cash App Pending Status Here Apps

:max_bytes(150000):strip_icc()/02_Cash_App-3f22fbebe8884a73b04ca583f1baa7bf.jpg)

How To Use Cash App On Your Smartphone

:max_bytes(150000):strip_icc()/03_Cash_App-facb0d3923c14a1c9e5195adfe4953cf.jpg)

How To Use Cash App On Your Smartphone

Send And Receive Stock Or Bitcoin

Best Payment Apps For August 2022 Apple Cash Cash App Paypal And More Cnet

What Does Cash Out Mean On Cash App Here S An Explanation And Simple Cash Out Method Apps

Paypal Vs Google Pay Vs Venmo Vs Cash App Vs Apple Pay Cash Digital Trends

The Cash Card Is A Free Debit Card That Is Connected To Your Cash App Balance

Cash App Vs Venmo Which Is For You